Candace Nakamoto, Volunteer Coordinator for the Hawaii State Health Insurance Assistance Program (SHIP) joins producer/host Coralie Chun Matayoshi to discuss Medicare Parts A, B, C, D, Medigap, what they cover, penalties (some lifetime) for signing up late, and how Medicare works when you still have private insurance, and where to get help understanding all of this.

Q. Medicare is something we can all look forward to for help in our golden years, but everything about it seems so daunting and confusing – Medicare Parts A, B, C, D, deductibles, lifetime penalties. Luckily Candace is here to explain. What is Medicare?

Medicare is health insurance offered by the federal government for individuals:

65 years or older,

under the age of 65 for people who receive Social Security Disability Insurance (after 24 months of disability they automatically get Medicare in the 25th month), or

with End Stage Renal Disease or ALS.

Q. What are the different parts of Medicare & what do they cover?

People equate Medicare to alphabet soup. There is Part A, B, C, D and Medigap. An easy way to think of Medicare is two separate doors. You can only choose one door.

Behind door 1 is Original Medicare which consists of:

Part A covers inpatient services, short term skilled nursing facility care (100 days), hospice, and home health care. Part A is usually premium free if you and your spouse have worked and paid into Social Security taxes for 40 quarters or 10 years. You can also qualify for premium free Part A if you have SSDI, ESRD, or ALS. People without 40 quarters can purchase Part A (30‐39 Quarters: $278/MO 2024; Less than 30 Quarters: $505/ MO 2024).

Part B covers outpatient doctor’s visits, emergency room, durable medical equipment like walkers, and wheelchairs, and preventive services like flu shots or health screenings. Everyone pays a Part B premium. In 2024 the base premium is $174.70. If you make a higher income, you will pay a higher premium (based off your reported income tax from 2 years prior: in 2024: individual $103,000 an couple $206,000). The annual Part B deductible is $240 in 2024.

Part D covers prescription medications. Under the federal Inflation Reduction Act, out of pocket prescription medication expenses will be capped at $2,000 per year starting in 2025.

Medicare Supplement Plans (Medigaps) are policies offered by private insurance carriers that offset some or all of the out-of-pocket costs for Medicare part A and B services.

Behind door 2 is:

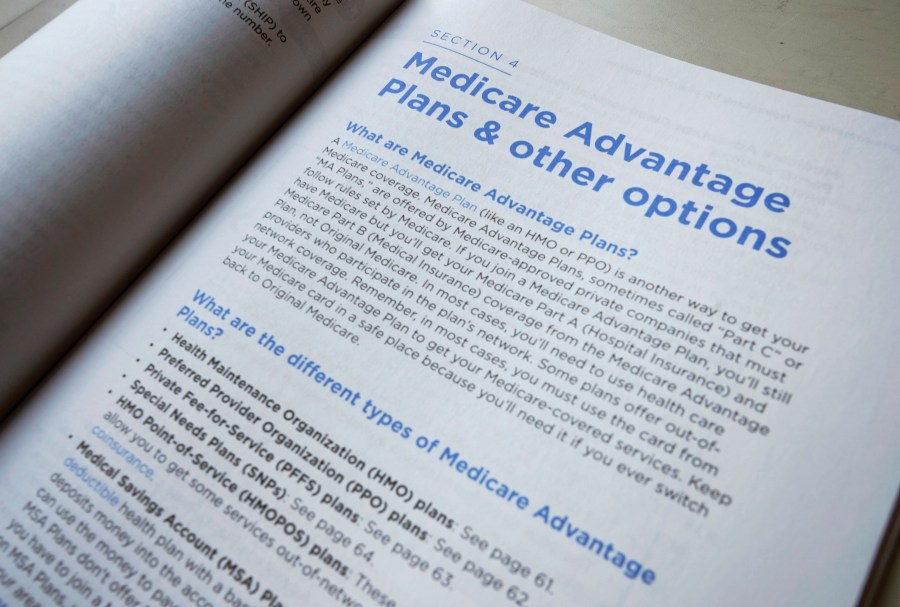

Part C Medicare Advantage is an alternative option to Original Medicare and is provided by private insurance carriers. Medicare Advantage plans don’t cover Part A and B deductibles, and each plan has different coverage amounts for different services. You must have Part A and B to get Part C. Part C usually includes prescription drug coverage bundled into the plan. Examples of providers include HMSA, Kaiser, United Health Care, Humana, Wellcare by Ohana, and Devoted Health.

Q. Does Medicare pay for long-term care?

No, Medicare does not usually pay for long-term care, nor does it pay for help with activities of daily living (e.g. eating, bathing, dressing, toileting). Medicare may pay for short term skilled nursing care or home health care when certain conditions are met including a period of prior hospitalization.

Q. When should you sign up for Medicare?

If you are already collecting Social Security benefits by the time you reach age 65, you will automatically be enrolled in Medicare. If you are not collecting Social Security benefits you will have to contact SSA by calling, going in-person, or applying for Medicare online. The first opportunity to enroll into Medicare is during the Initial Enrollment Period. The IEP begins 3 months before your 65th birthday, includes your birth month, and ends 3 months after (unless you are born on the first of the month: 4 months before your 65th birthday, the month of your birth, and 2 months after). If you enroll the 3 or 4 months before your 65th birthday coverage will start on your birth month. If you enroll on your birth month or the 3 or 2 months after, coverage will start the following month.

If a person continues working and has creditable coverage (as good or better than what Medicare offers) and their employer doesn’t require them to enroll into Medicare, it’s possible to delay Medicare enrollment until after they retire or lose employer group health plan coverage. Upon retirement or loss of active employer group health plan coverage a person has a Special Enrollment Period to sign up for Medicare without penalties. A person has 8 months from the time they lose employer insurance to sign up for Part B, and 63 days to sign up for either Part C or Part Dprescription drug coverage.

Q. What happens if a person is late signing up for Medicare?

If you do not enroll when first eligible and have no other forms of creditable health insurance, you may face late enrollment penalties. Medicare implements late enrollment penalties as incentives for people to sign up for Medicare not only when they need services. The penalties are as follows:

Part A Penalty

Monthly premium may go up by 10%.

You will have to pay the penalty for twice the number of years you didn’t sign up.

Example: If eligible for 2 years but didn’t sign up, one will pay a 10% higher premium for 4 years (2 x 2).

Part B Penalty

10% of the Part B premium ($174.70 in 2024) for every 12-month period from when you were first eligible to enroll in Medicare.

Example: You enrolled 3 years late. Penalty: 30% of $174.70 (about $50/month x 12 months = $630/year) will be added to your Part B premium for life.

Part D Penalty

Multiply 1% of the “national base beneficiary premium” ($34.70 in 2024) times the number of full, uncovered months you didn’t have Part D or creditable coverage.

Example: You enrolled 12 months late. Penalty: 12% of $34.70 will be added to Part D premium for life.

Q. Can you make changes to your Medicare coverage?

People already enrolled in Medicare can make changes to their coverage options during the Annual Enrollment Period (Open Enrollment Period) that runs from October 15 to December 7 each year. Any changes you make go into effect on January 1 of the following year. There is also the Medicare Advantage Open Enrollment Period every year from January 1 to March 31 where people on Medicare Advantage/Part C can make a one-time switch. New plans start the first day of the following month after sign up.

Q. How does Medicare work if you still have private insurance?

Q. What is Medicaid?

Medicaid is a state and federal program for individuals with limited income and assets.

Hawaii Medicaid is run by the Department of Human Services (DHS). Medicaid in Hawaii is called Med-QUEST.

Medicaid is another form of health insurance.

Medicaid covers adults, children, and the aged, blind, and disabled. Each group has a different income and asset requirement.

Medicaid pays for benefits that Medicare might not such as long-term care coverage, transportation, etc.

Medicaid will pay for Medicare Part A and B premiums, late enrollment penalties, and copays/coinsurances.

If a person has Medicare and Medicaid, they are considered a dual eligible (Medicare pays 1st and Medicaid pays 2nd resulting in minimal out-of-pocket expense).

Q. How does a person 65 years or older qualify for Medicaid?

To be eligible for Medicaid a person:

Must be a resident of the state of Hawaii, a U.S. national, citizen, permanent resident, or legal alien, in need of health care/insurance assistance.

Have limited income and assets. The general income and asset threshold for 2024 is:

Income per month: Individual: $1,443 and Couple: $1,900

Assets: Individual: Individual: 2,000 and Couple: $3,000

Income includes Social Security benefits, pay checks, and Social Security Disability payments.

Assets includes pension, 401K, mutual funds, checking, savings, stocks, bonds, etc.

Assets includes the home you live in, car, household items, burial plot up to $1,500, and life insurance policies with cash value up to $1,500.

To apply for Medicaid a person can contact the Med-QUEST office, apply online, or a Hawaii SHIP volunteer can help them complete/submit an application.

Q. If anyone has more questions, who can they call?

If anyone has Medicare related questions, they can call our 24/7 pre-recorded helpline (808-586-7299) and leave a detailed message with their name, number/email, zip code, and a brief description of their question. A certified SHIP volunteer counselor will call them back within less than 5 business days to address any questions that they might have.

Additional Resources

Medicare Financial Assistance Program Info Sheet

To learn more about this subject, tune into this video podcast.

Disclaimer: this material is intended for informational purposes only and does not constitute legal advice. The law varies by jurisdiction and is constantly changing. For legal advice, you should consult a lawyer that can apply the appropriate law to the facts in your case.