HONOLULU (KHON2) — Notice any extra fees or surcharges on your receipts? State officials are warning consumers to pay attention to their purchases.

This comes after some businesses are not complying with consumer protection rules.

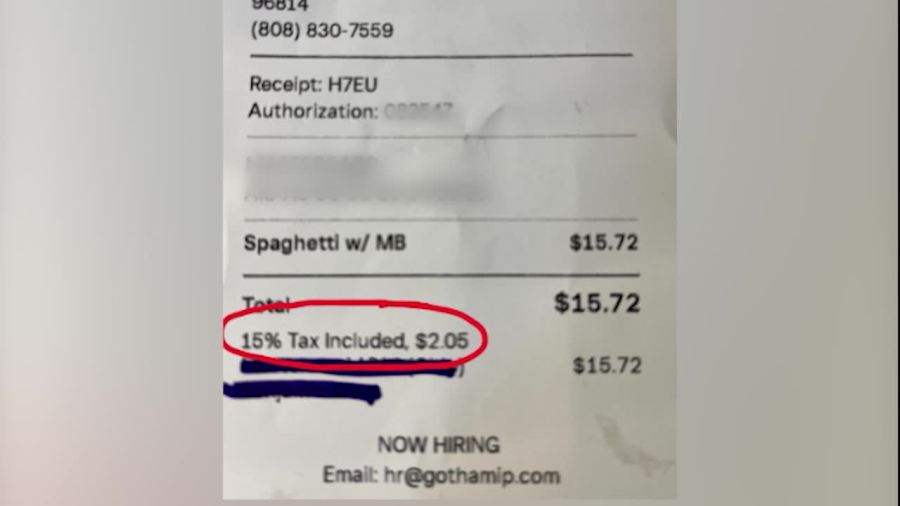

A recent purchase at a fast food chain had one customer shocked at the register. At the bottom of the receipt was a 15% tax included.

KHON2 asked if this was normal and Victor Lim from the Hawaii Restaurant Association said “I was totally surprised because I never seen someone charge 15% tax here before.”

A receipt showing a 15% tax included on a customer’s purchase at a fast food chain located in Hawaii.

“That was done completely wrong. There is no way that that tax was disclosed in the appropriate way,” said Mana Moriarty, executive director of the Office of Consumer Protection.

According to the state, this clearly violates consumer protection laws that safeguard consumers from surcharges. Officials said any tax added on to your transaction cannot exceed a certain amount.

“The current tax rate cannot exceed 4.712%. In some instances, it might actually be lower but the important thing to remember is the maximum is 4.712%,” Moriarty explained. “Those passed-through charges should be itemized in the receipt from the transaction that you receive from the business.”

Another viewer sent in a receipt from a different fast-food chain, asking if the food and beverage taxes listed are acceptable.

A receipt showing a food and beverage tax at a fast-food chain located in Hawaii.

The state said in this case, the business is compliant. The items are clearly listed and it doesn’t exceed the GE tax rate.

If you have concerns about a transaction or want to submit a complaint, you can do so with the Office of Consumer Protection.